With Congress’s latest CARES Act signed on March 27th (Coronavirus Aid, Relief, and Economic Security), $2.2 trillion stimulus package is going to hit the market. Leaving the $1,200 checks for American Citizens aside, the other biggest chunk is a $349 Billion Paycheck Protection Program (PPP) enabled through Small Business Administration (SBA) for offering loan guarantees to small businesses that are impacted by Coronavirus.

This stimulus package is certainly a good step for injecting dollars into the economy and saving small businesses, but from a bank or credit union perspective, there is going to be a huge inflow of PPP SBA Loan requests and a tremendous load on workforce in processing those loans in coming weeks & quarters.

To put this into perspective, a developing story in a Forbes Article highlights that Bank of America has received applications from 177,000 small businesses accounting for $32.6 billion. In FY 2019, the SBA approved $28.2 billion in loans and more than 63,500 loans to small businesses (refer this Annual Report by SBA, Page 11). This means within 10 days of stimulus package release, there has been almost 3 times increase in loan requests, almost 1.2x of total the loan amount that was disbursed all along last financial year. This should give a sheer volume of requests and processing efforts required by banks and credit unions to be prepared with.

While Banks would have the necessary core banking platforms & systems for processing the loans, this sudden deluge would need additional hands and tools to process. That is where we believe RPA can play a significant role in reducing manual efforts and enhancing the cycle time. As highlighted in the previous blog , RPA can help organizations survive the pandemic and plays a key role.

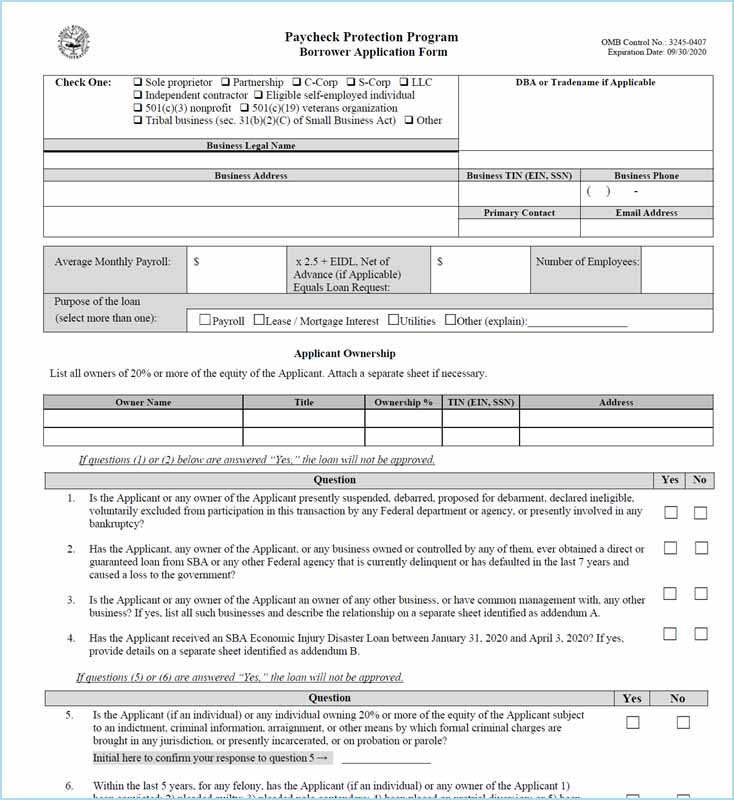

Again, to put things into perspective below is the sample PPP form that every small business must fill in and apply to Banks. As it can be seen below, the form can be filled in either by editable fields or by manual entry depending upon the preferences. There are many ways of automating this form and associated processes. For example

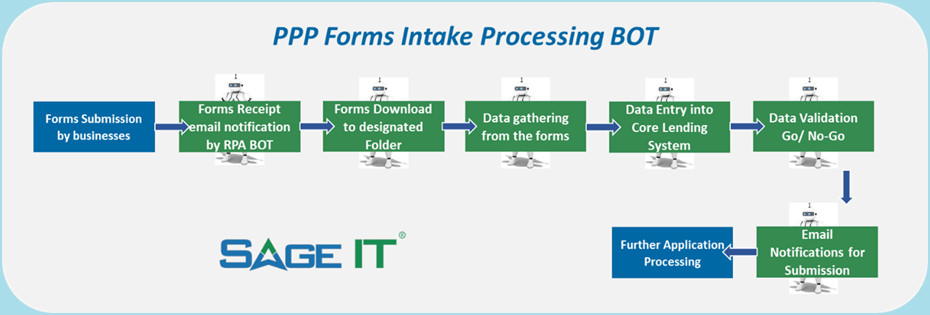

RPA Process 1 – Automation of Forms Intake

As of now none of the small businesses even know if their application has been received. With a dedicated Forms Intake BOT, many applications can be processed with unattended BOTs and address the needs timely.

Sample PPP Form

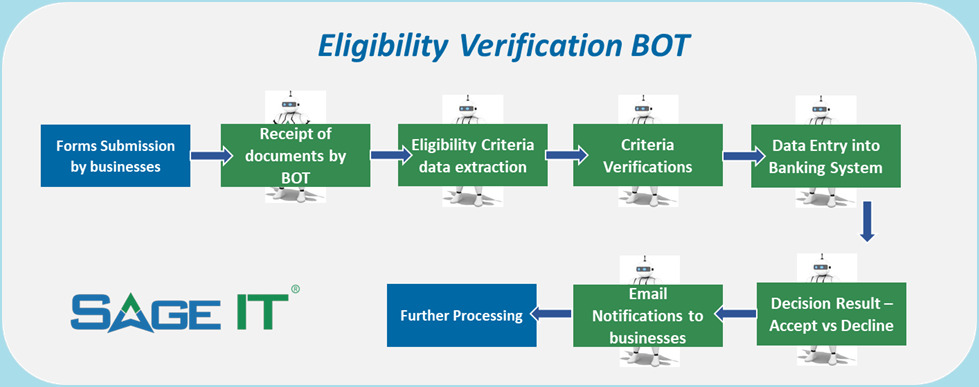

RPA Process 2 – Eligibility Verification BOT

For verifying the submitted documentation by each business mainly to check if they even qualify and are eligible for SBA set guidelines, this BOT can be leveraged.

The above two processes for RPA are only for reference and may have many variations. There could be many differences in the way Banks execute this whole process, but on a high level these should apply. Also, there are many more processes that can be automated with RPA & AI/ML engines like Reporting, Audit, Payment release, Fraud management, Grievances etc.

As a next step, Banking and Lending organizations should immediately look at their current setup and mobilize teams to adopt RPA. Sage IT can help in identifying effective process construct to handle the surge and on-board task-based BOTs or process specific BOTs within a reasonable time frame. Please reach out to [email protected] or [email protected] with any requests.

We hope all the companies, including us sail through this situation successfully and with the help of right advanced technology like RPA, we believe anticipated long-term results can be achieved.

POST WRITTEN BY

Gopi Krishna V Akella

Vice President – Sales & Business Development at Sage IT Inc.