With the release of guidance by SBA for PPP Loan Forgiveness, there is some clarity to small business owners on the overall process and where do they stand in gaining complete vs partial forgiveness. While there has been some panic in the market with many business owners doubting if they have violated any terms, there is a bit of relief with SBA offerings more details over this weekend (read here).

While the total figures are to yet to come, as of May 6th per SBA’s flash report there are almost 4.1 million loans approved totaling nearly to $525 Billion in both waves of funding release (on April 3rd and April 27th).

For these many loans approved, every borrower has to file a Loan Forgiveness Application with precise details and calculations along with additional documentation for both payroll and non-payroll costs.

The application form has almost 70+ fields to be entered by borrowers. Although many banks have collected relevant information upfront, there may not have been a verification of documentation submitted and so each application is going to come with loads of additional documents from each borrower.

In the first leg of the PPP process, RPA helped banks in varied capacity and became such a significant technology lever, that SBA got overwhelmed by BOTs accessing E-Trans and loading the system. For this forgiveness process now, RPA would play much more significant role to enable lenders to quickly extract the data and match for validations and for future audit needs that may arise per SBA requests.

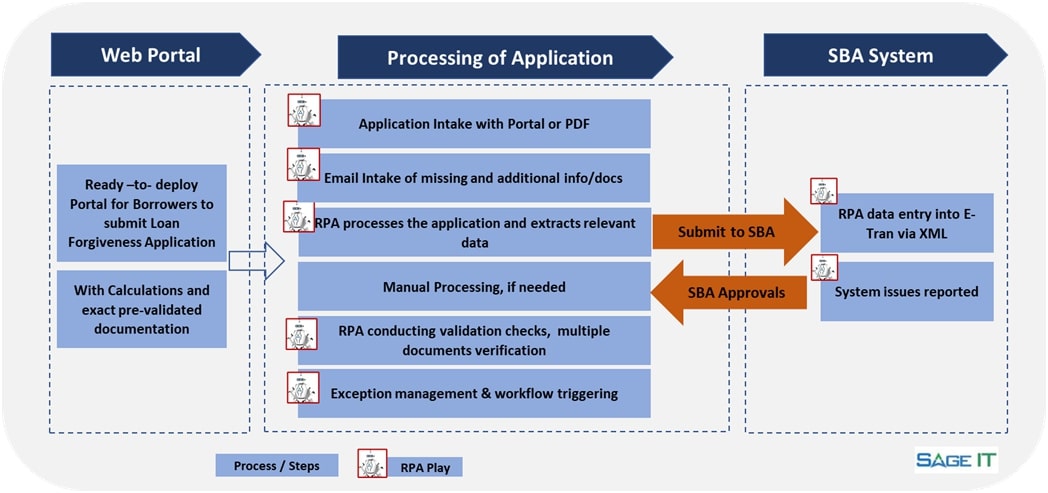

Below process highlights the RPA play at this stage of PPP lending process.

Many lenders have utilized a mix of solutions including RPA to address the process, but at this juncture Sage IT believes the need of RPA is much higher. Sage IT recommends continuing the investments in RPA to reap the benefits by onboarding digital workforce for greater speed and accuracy along with cost avoidance for potential non-compliance issues with evolving SBA guidelines. With a 48 to 72 hours of RPA deployment solution and hands on experience in solving the loan forgiveness challenges, Sage IT can be a value adding partner for addressing the forgiveness process automation.

For more information and any assistance, please reach out to [email protected] or [email protected]

POST WRITTEN BY

Gopi Krishna V Akella

Vice President – Sales & Business Development at Sage IT Inc.

Please visit our Blogs Page for more enthralling articles like this one!